Accounting and Bookkeeping for Construction Business in Vancouver-Green Quarter Consulting Surrey BC

You’ll complete some initial paperwork to provide us all the information that we need. We’ll set up your accounting file in Xero and a document storage account in either Hubdoc or Receipt Bank. We’ll show you how to easily send us all the paperwork we need to manage your bookkeeping and payroll. Our dedication to outstanding client service enables us to develop forward-looking financial strategies.

Ontario has $12.7-billion school repair, construction shortfall, budget watchdog says

Managing finances effectively is crucial for general contractors to ensure business success and long-term stability. Construction accounting requires careful attention to detail, as the industry’s unique nature demands accurate tracking of expenses, cash flow, and taxes. By implementing strong construction bookkeeping services, contractors can gain clear insight into their financial position, make informed decisions, and avoid common pitfalls that may hinder business growth. The percentage of completion method is a type of accrual accounting, but it recognizes revenues, expenses, and profit based on how much work is already finished on a project. This accounting method is particularly useful for large construction businesses and companies with long-term contracts. By following these essential tips, general contractors can maintain organized and accurate financial records, allowing them to make informed business decisions.

Try our calculator and compare the costs of hiring an employee vs. outsourcing your bookkeeping.

- If the individuals providing labour are self-employed contractors or sub-contractors and are not employees who are issued T4’s, there is a contract payment reporting requirement imposed on the person making payments to them.

- A contractor using the completion method can change to the more accurate percentage completion method at any time, without prior approval, but having done so is precluded from ever using the completion method again.

- «We are meeting the needs of growing communities with 240 new schools under construction that will create 81,000 pupil spaces in the coming years.»

- However, no matter how the contract price is set, it is almost always necessary that revenues and costs be segregated in the accounts by project.

- General contractors should not only focus on current projects but also plan for future growth.

- It’s vital to control your costs to boost your profitability and improve your chances of winning a bid.

Streamline your financial management with our comprehensive remote and on-site accounting and bookkeeping services. Our team of professionals makes sure that you get accurate, timely financial insights that will help you make informed decisions and drive business growth. The completed contract method recognizes revenue, cost and profit only when the contract has been completed. Progress billings made and costs are all accumulated throughout the course of the contract on the balance sheet and are closed out to the income statement once the project has been completed. This method should be used when reliable estimates of the degree of completion are possible and costs can be estimated with some accuracy.

New FAO report looks at what’s needed to clear backlog of school repairs, prepare for growing enrolment

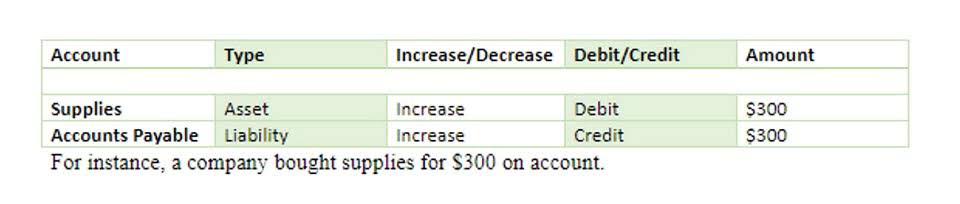

Assets are a company’s financial resources — in other words, anything that is cash or could likely be converted to cash. Since 15 percent of the expected costs have been incurred, the company will also recognize 15 percent of the expected revenue and expected profit on its books. Keep in mind that certain methods are unavailable to large companies with high annual revenues. Additionally, while a manufacturing company can produce and store items for later demand, a construction company can only begin production once a contract is signed and a project is underway.

However, all three sections are related, as total assets are equivalent to the sum of liabilities and equity. This cycle continues throughout the life of the construction company, which gains a competitive advantage by using real-world job cost data to optimize bids, estimates, profit margins, and more. By contrast, good bookkeeping helps you optimize and reallocate costs, demonstrate your integrity, and ensure you’ll have sufficient cash flow to complete your projects. Most importantly, How to leverage construction bookkeeping to streamline financial control construction bookkeepers can thoroughly track all your expenses and income for your various projects. Especially if you receive a large project fee and then have nothing but expenses for a few months, you want to clearly demonstrate your viability to financial institutions and prospective clients. And in the event that you are audited by the CRA, you must have clear financial records from every project.

- Depending on their commercial arrangement, a contractor and its sub-trades may have the ability to manage their relationship so as to create either an employment or self-employment relationship.

- Properly managing and allocating overhead expenses is crucial for contractors, as it directly impacts the company’s profitability and long-term financial stability.

- Job costing creates a powerful cycle where previous financial data leads to better financial decisions in the future.

- So, to protect your bottom line and your construction business’s overall health, consider investing in a specialized bookkeeper.

- On top of that, construction is a notoriously volatile industry with a high failure rate, slow time to payment, and inconsistent cash flow.

- Two typical pricing models are the cost-plus or fixed-fee contract and the fixed-price or unit-price contract.

- These accountants understand that you are operating in a competitive environment.

- Unlike standard bookkeeping, construction bookkeeping requires project-driven financial reporting.

- Consequently, a number of contractors need help with their bookkeeping and the preparation of income tax returns.

- Reconciling bank statements is an important task ensuring your records match your business account’s actual transactions.

- The percentage of completion method is a type of accrual accounting, but it recognizes revenues, expenses, and profit based on how much work is already finished on a project.

It is sound practice always to check the published information available for the province in question and, where there is doubt, to confirm your understanding with the retail sales tax authorities. The CRA accepts that a statutory or contractual holdback that has been billed by a contractor is not actually receivable until such time as the holdback conditions have been released. The Financial Accountability Office https://www.inkl.com/news/the-significance-of-construction-bookkeeping-for-streamlining-projects wrote in a report that the provincial government’s 10-year capital plan allocates $18.7 billion for school buildings, resulting in a shortfall of $12.7 billion. The Financial Accountability Office wrote in a report that the provincial government’s 10-year capital plan allocates $18.7 billion for school buildings, resulting in a shortfall of $12.7 billion.

- See below for the latest data on international student tuition across Canada, excluding housing costs and ancillary fees.

- If you are looking for an accountant that wants to partner with you and get to know your construction business, reach out and speak to an expert.

- Procore is committed to advancing the construction industry by improving the lives of people working in construction, driving technology innovation, and building a global community of groundbreakers.

- This helps you monitor project costs, manage your budget effectively, and ensure you have the right information for tax reporting.

- However, the CRA will normally only allow the completed contract method to be used where it is anticipated that the contract will be complete within two years of the date it commences.

The landlord uses a designer and provides the contractor with detailed specifications. It is agreed that contract labour will be priced at $35 an hour, which will represent its cost. Periodically, the contractor will provide the landlord with an invoice, detailing the costs that have been incurred, and adding 15% as the contractor’s profit margin. The T5018 is an information slip that identifies the total contract payments including GST/HST made by the contractor to a recipient during a calendar year or a fiscal period. The issuer is not required to provide a copy of the T5018 Supplement slip to the recipient but generally will.