Instructions for Form 3903 2023 Internal Revenue Service

This payment has been considered as part of my total income (per my paycheck) which is reported in box 1 of my W2. In addition, my paycheck mentions a «deduction» for this relocation expense (with a dollar value around 60% of the total moving expense), and this second number is reported in box 14 of my W2 with a «RELOC» code. You can’t deduct moving expenses for which you were reimbursed, nor can you deduct moving expenses that were paid for by the government. If your reimbursement exceeds your total out-of-pocket expenses, you won’t be able to deduct your moving expenses, and you’ll have to claim the excess reimbursement as taxable income. But if your personal expenses were more than the amount that you were reimbursed, you can deduct your out-of-pocket moving expenses to reduce your taxable income. The moving expense deduction is one of the few tax deductions you can claim before knowing whether you satisfy the requirements.

- Likewise, if you serve as an active-duty military member, you can claim moving deductions against your taxable income and include them on Form 3903 as an attachment to your Form 1040.

- TurboTax will calculate whether you should use itemized deductions or the Standard Deduction to lower your taxable income as much as possible.

- U.S. Senators Elizabeth Warren (MA), Richard Blumenthal (CT) and Bernie Sanders (VT), along with Representative Katie Porter (CA), sent a letter to Intuit, the parent company of TurboTax, on January 31.

- You will either include the original deduction amount in “other income” on your next tax return or amend the original return to calculate your tax without the moving expense deduction.

Changing jobs can be a huge transition that affects several areas of your life, including your taxes. To receive guidance from our tax experts and community. You would have to make the argument that the fact that the moving company moved you in 2018 proves constructive receipt of the money in 2018, even if the DoD didn’t pay the turbotax moving expenses movers until 2019. If you want to assert that the moving company was paid before November 12, 2018, you will have to prove it. Another way would be to get a statement from the movers, if they can even find the documents and are willing to provide them. Learn about the new moving tax deduction rules and what you need to know.

Track self-employed expenses year-round with TurboTax Expense Monitor

Don’t deduct any expenses for moving or storage services provided by the government. While the moving expense deduction won’t leave you any less physically sore from all that heavy lifting, the tax savings you have to look forward to might lessen some of your financial pain. This $10,200 exclusion is currently only available for benefits received in 2020, and any benefits more than that amount will be taxable. If you’ve already filed your 2020 tax return, you don’t need to file an amended tax return. The IRS plans to automatically process refunds for taxpayers who filed their returns before the new legislation passed. How much you owe on unemployment payments depends on your tax bracket and other deductions and credits you may be able to claim.

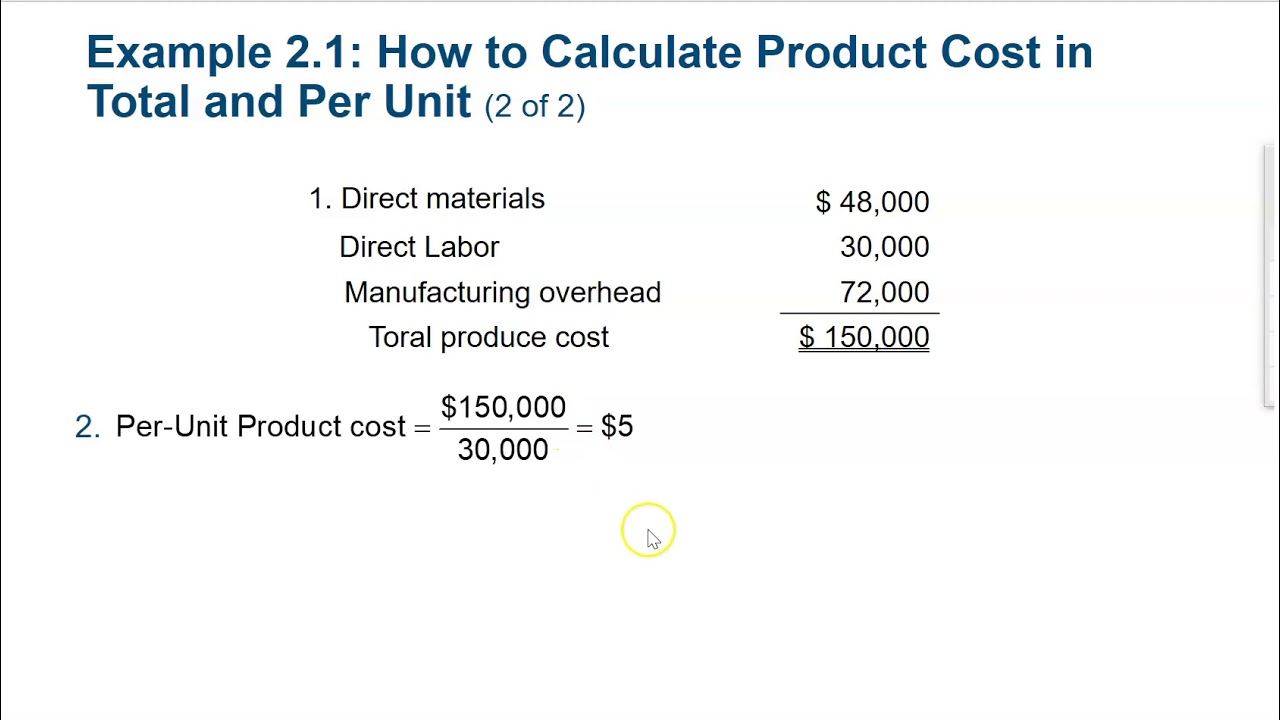

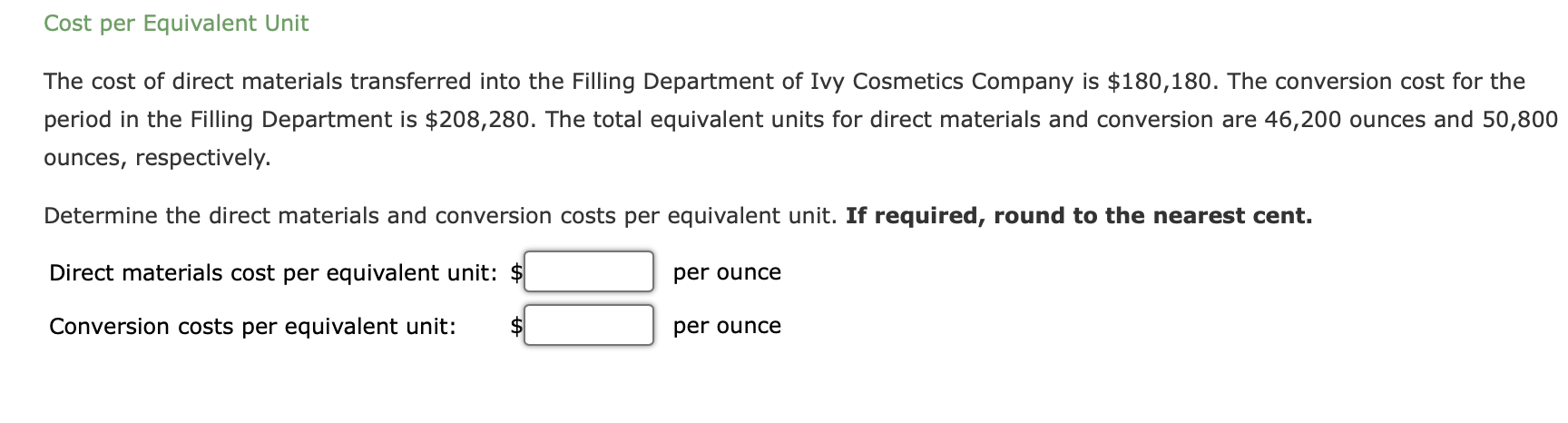

Enter the amount you paid to travel from your old home to your new home. This includes transportation and lodging on the way. The members of your household do not have to travel together or at the same time. But you can only include expenses for one trip per person. Enter the amount you paid to pack, crate, and move your household goods and personal effects.

You would probably also get a letter from the IRS, and you would have to make the same explanation to them, with the added note that you reported the income and paid the tax on your 2018 return. If you move to a new home because of a new principal workplace, you may be able to deduct your moving expenses whether you are self-employed or an employee. But you must meet both the distance and time tests that follow prior to completing line 1 through line 5 of form FTB 3913. Also, your move must be closely related both in time and place to the start of work at your new job location.

Distance test requirements

You can only deduct the cost to move you and the cost to move your stuff if you are a member of the armed forces on active duty due to a military order. In practice, that means you can deduct the cost to pack and ship your possessions but not the cost of new decorations that go much better in the new place. All features, services, support, prices, offers, terms and conditions are subject to change without notice.

A checkbox was added to certify that you meet the requirements to claim moving expenses. See Specific Instructions, later, for how to report this deduction. You don’t actually know when the moving company was paid, you are only assuming it was in 2018. If the moving company was paid in 2019, that is 2019 income to you, and since you were an Arizona resident in 2019, it is Arizona taxable income. I would suspect that the DoD did not pay the movers right away. 30 days would be a minimum, and longer is certainly possible.

About Form 3903, Moving Expenses

You can deduct the cost of moving to your home but not any of the earlier trips you took while you were looking for a place to live. You can even include any lodging you paid to get from your old home to your new home, but you can’t include the cost of meals. Get into the habit of saving all the tax forms, receipts for deductible expenses, and other important tax records in one place so you’ll have everything you need to prepare your tax return.

Use Form 3903 to figure your moving expense deduction if you are a member of the Armed Forces on active duty and, due to a military order, you move because of a permanent change of station. Like moving expenses, job-hunting expenses are only deductible for tax years prior to 2018 and only if you itemized deductions on Schedule A. In this case, you can still deduct your moving expenses even though your move occurs long after your first day of work. But if you need to amend a previous return prior to tax reform, or if you serve in the active military and meet certain circumstances, you may qualify for a deduction.

If neither of these describe your situation, you may still want to track your expenses because some states continue to provide a deduction on your state tax return if you meet specific requirements. Unfortunately, you can’t deduct any expenses for meals, or any moving expenses covered by reimbursements from the government (or paid for directly by the government) excluded from your income. For https://turbo-tax.org/ unemployment benefits received in 2020, the American Rescue Plan Act gives some people with unemployment income a break on taxes. Typically, when you leave a job, you may receive severance pay or accrued vacation time. These payments are taxable income, which means they’re subject to the same federal (and possibly state) income taxes, Social Security taxes, and Medicare taxes as other wages.

If you must make estimated tax payments, you need to take into account any taxable reimbursements and deductible moving expenses in figuring your estimated tax. If you wanted to stake a consistent claim that this was 2018 income, you would have to file an amended 2018 return to report this as federal taxable income, and then file amended 2019 returns to remove it. (Or, if these questions are the result of you getting a corrected W-2 and trying to figure out if you need to amend 2019, you would amend 2018 instead.). You would then expect to get a letter from Arizona assessing tax and penalties for not reporting the income for 2019 and paying tax. You would have to explain your argument that this was income from before your change of domicile (November 12, 2018) and see if they accept it.

At tax time, all you have to do is import to get you every dollar you deserve. Between gasoline, packing materials, moving assistance, and insurance, the costs can really add up. Often, you have to come up with closing costs or security deposits at the same time as the move.