QuickBooks Online vs Desktop: Which Is Right for You in 2024?

Consider the QuickBooks Pro Plus + Payroll plan if your business needs built-in payroll. In addition to everything you receive in QuickBooks Pro Plus, you’ll also have access to Enhanced Payroll. Like adp vs paychex 2020 its other plans, Intuit frequently runs discounts for this service on its website. Terms, conditions, pricing, special features, and service and support options subject to change without notice. Subscription clients in QuickBooks Desktop 2023 (R1) or older versions will need to update to the latest 2023 (R3) version before their subscription expires. The banking section of this case study focuses on cash management, bank reconciliation, and bank feed connections.

Integrations are third-party add-ons that give you additional features and capabilities. For example, software such as Shopify, QuickBooks Time, and Mailchimp are all integrations. QuickBooks Pro offers 244 integrations to choose from, QuickBooks Premier has 241 integrations, and QuickBooks Enterprise offers 247 integrations. When purchasing QuickBooks Desktop Pro, there are several additional fees to be aware of. Intuit isn’t always very forthcoming with these add-ons and fees, so we wanted to share them.

QuickBooks Enterprise

Merchant Maverick’s ratings are not influenced by affiliate partnerships. Platinum or Diamond may be the way to go if you need advanced inventory and pricing. If you need more users than you can get with QuickBooks Premier but don’t need advanced features, then maybe Gold is a better option.

To apply, you must be eligible under our Acceptable Use Policy. Ability to accept credit card and ACH through Intuit Payment Network may require separate application. QuickBooks Enterprise has significantly fewer additional fees than QuickBooks Pro and Premier since many features are included with your annual subscription. As a QuickBooks ProAdvisor, Mark has extensive knowledge of QuickBooks products, allowing him to create valuable content that educates businesses on maximizing the benefits of the software.

Stay in sync with the QuickBooks mobile app and work where you want. Send invoices, run reports, and get mobile alerts for key events—all on your smartphone. Yes, you can, but the process is a bit tedious, as you need to export your files from QuickBooks Online to Desktop manually. If you are currently using QuickBooks Online and want to switch to an interface similar to QuickBooks Desktop, we recommend using the QuickBooks Online Desktop app. Read our article on what the QuickBooks Online Desktop app is to learn more. QuickBooks Online is cheaper than QuickBooks Desktop if you need multiple users.

QuickBooks Silver VS Gold VS Platinum VS Diamond

Our unbiased reviews and content are supported in part by affiliate partnerships, and we adhere to strict guidelines to preserve editorial integrity. The editorial content on this page is not provided by any of the companies mentioned and has not been reviewed, approved or otherwise endorsed by any of these entities. The vendors that appear on this list were chosen by subject matter experts on the basis of product quality, wide usage and availability, and positive reputation. By providing feedback on how we can improve, you can earn gift cards and get early access to new features.

Take Enterprise for a spin

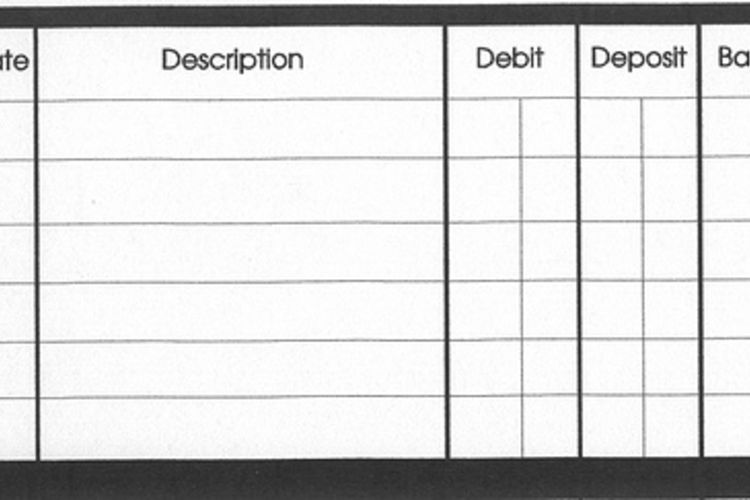

The software must have bank integrations to automatically feed bank or card transactions. The bank reconciliation module must also let users reconcile accounts with or without bank feeds for optimal ease of use. Lastly, the software must generate useful reports related to cash. QuickBooks Online wins for pricing because it’s essentially more affordable than QuickBooks Enterprise. For instance, if you have five members, you can purchase the Plus plan for only $90 monthly, whereas with Enterprise, you need to pay $427 monthly for five users. We developed an internal case study to evaluate the accounting software we review subjectively.

- Lastly, our expert opinion score is our subjective rating based on our experience in trying the software.

- Word and Excel integration requires Office 2010 SP2 and above, or Office 365.

- Meanwhile, QuickBooks Online provides some customization options for businesses, but they’re not as extensive as those in Enterprise.

This easy-to-use and feature-rich software is ideal if you have no bookkeeping experience and want top-notch customer support. There’s also a side-by-side software comparison chart for QuickBooks features and prices. You can switch from QuickBooks Pro Plus to QuickBooks Premier Plus or go from QuickBooks Premier Plus to QuickBooks Enterprise — whatever your heart desires (and your business requires). If you want cloud hosting, QuickBooks Enterprise also has each of its plans available with cloud access. Unfortunately, QuickBooks is no longer forthcoming with the pricing of its QuickBooks Desktop products.

See why Desktop users are making the switch to QuickBooks Online. Additionally, all versions of QuickBooks Desktop allow you to set up cost estimates for projects and then compare them to actual expenses. In contrast, you need to upgrade to Advanced to be able to use QuickBooks Online’s budget vs. actual reporting feature. QuickBooks Online wins because it offers more professional-looking and customizable invoices than QuickBooks Desktop. In fact, it recently upgraded its invoicing tool where you can now see the final look of your invoice as you complete the invoicing form. This allows you to easily customize the invoice based on how you want it to look without clicking the preview button.