How To Balance a Checkbook in 5 Simple Steps

At the end of the month, you compare the ledger with your account statement to balance your checkbook. You may prefer online and mobile banking for checkbook balancing if you don’t write paper checks or only write a few each month. Keep in mind that checks won’t show up in your transaction history until the transaction has been posted, so you still need to keep track of those amounts when calculating your current balance.

Stay on Top of Your Current Balance

You can go back through the online checkbook register and mark transactions as «Cleared». This way you will always know what transactions have been cleared with the bank and how much money you have. We also have some additional premium features that can be activated for a very small monthly payment. With the advent of the digital age, checkbooks have become obsolete.

You’re our first priority.Every time.

Balancing your checkbook is the process of reconciling the bank’s record of your account activities with your own. If you use checks semi-regularly you’ll want to get into the habit of balancing your checkbook. This is the best way to make sure your record of transactions matches your bank statement.

What are the different types of checking accounts?

When you enter deposit or payment amounts into the register and add or subtract them from your balance, you have a quick reference for how much accessible money you have in your account. However, checks can take up to a few days to process and clear, or the recipient may not cash them right away. If that is the case, your bank account balance may not accurately reflect the amount you actually have available. It’s useful for paying bills, depositing paychecks, sending money, and making purchases using a linked debit card.

How to use checkbooks – and are they even still relevant?

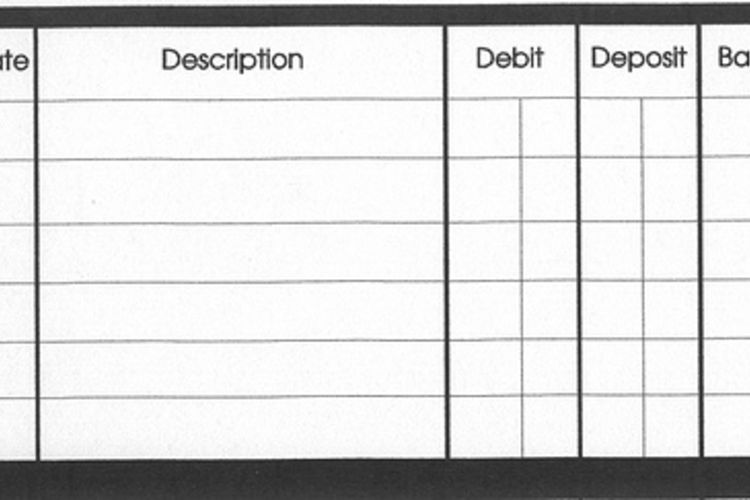

Checkbooks include a set quantity of numbered checks and usually contain some type of register in which users can keep track of check details and balance account statements. Before being handed over in exchange for goods or services or any payment, a customer must fill out certain information on the check and then sign it. The information to be filled out includes the date, the name of the individual or business, and the amount of funds to be withdrawn.

- Checkbooks include a set quantity of numbered checks and usually contain some type of register in which users can keep track of check details and balance account statements.

- As a business owner, you need to know how to complete a check register.

- Go to your bank account(s) and write down the amount (or amounts if you have multiple checking accounts).

- Some businesses charge convenience or processing fees for credit and debit card payments.

- Checks are a pretty failsafe method if you can’t cover the amount in cash.

How do you keep checks secure?

Update your check register each time you spend cash or write a check to ensure you have an accurate balance. One easy way to review transactions is to mark the transactions that are legitimate and that you’ve cross-referenced with your check register. These are items that haven’t yet shown as transactions in your account, but that you’re certain will be credited. This article will walk you through the process of balancing a checkbook so that you improve your small business accounting processes. Here’s what you need to know about balancing your business checkbook. If you’re only recording check transactions, you can still compare your recorded checks to the check withdrawals on your statement.

Online transactions and digital account tracking are becoming increasingly popular. However, a checkbook can still be an excellent tool to help you manage your money. Using a spreadsheet or ledger can also help you stay on top of your checking account balance.

Additionally, the last few sheets in a checkbook typically include several deposit slips. Transactions that are listed in your checkbook register may not show up on your account statement if they’re still marked as pending with the bank. The rise of digital tools has helped make checkbook balancing a lot easier than the old pen-and-checkbook-register process. If you have online banking, you can get an up-to-date list of transactions online.

You know from experience that your bank will credit the full amount to your account on Monday. Or you might know that your paycheck always arrives in your account on a certain day. Once you have your current balance, you will need to record pending transactions as you make them. The number of transactions you make within a given period will vary depending on the period in which you are looking and how your business’s cash flow works.

The business owner will continue to record each withdrawal and deposit to track their current balance and how much money they have in their account. This running balance lets them know checkbook accounting the precise dollar amount in their account. They can record their balances for a given accounting period, such as at the end of the month, as they keep an eye on their business growth.